The Form CP30 Apportionment Of Partnership Income has to be provided to each partner so as to enable them to declare their partnership income within the stipulated period ie. If Yes also complete item F10 on page 4 of the Form P.

Company Formation Services In Bahrain Financial Strategies General Partnership Business Structure

However LLP with capital contribution of RM25 million or less will enjoy a preferential tax rate of 19 on the first RM 500000 of its chargeable income.

. 30 June for individual and 7 months after. According to 3E Accounting Malaysia the precedent partner is responsible for filling out the Form P and issuing the Form CP30 to each and every partner. The highest income tax rate chargeable towards a Limited Liability Partnership is only at a 24 flat rate compared to conventional partnership which is higher at 28.

The precedent partner is responsible for filling out the Form P and issuing the Form CP30 to each and every partner. 3 Partnership Registration No. Enter 1 in the box for Yes if the partnership carries on a business in selling any goods or rendering any service online.

If you require a copy of the Form P you may use Ask Jamie our Virtual Assistant available 247 at this webpage or Chat with us online to resolve your tax matter quickly. While a partnership does not pay tax it still has to file an annual income tax return called the Form P to show all income earned and business expenses deducted by the partnership during the year. 3 Guidelines for completing this form.

General submission due date. The deadline for filing Form P is 30 June. 30 June for individual and 7 months after closing of financial year for companies.

Income to be Declared Income to be declared includes all income accruing in or derived from Singapore or. The precedent partner is responsible to file Form P to declare all income losses expenses profit loss and assets based on the profit and loss account and balance sheet of the partnership business. Ad Get Your Partnership Agreement Today.

Bhd a Limited Liability Partnership with capital contribution of MYR 25million or less will enjoy a preferential tax rate of 20 on the first MYR 500000 of its. LHDNM has to be notified in writing in case of any amendment to the Form P already submitted. The Form CP30 has to be provided to each partner so as to enable them to declare their partnership income within the stipulated period.

Please update Accounting and Corporate Regulatory Authority ACRA or relevant regulatory authorities for any changes in partnership particulars. RM 80000 onwards depend on the complexity of transactions if accounts are not done by us LHDN LLP Tax Requirements. I receiving orders for goods or services.

1 a Due date to furnish this form. The partnership could file Form P through paper-form submission or e-filling. The CDA programme in Malaysia was unveiled as a collaboration framework between Cisco and MyDigital Corporation in May 2022.

The Form P is not available for downloading from the website. As is normal practice all business records must be kept for a period of 7 years for audit purposes. The Form CP30 has to be provided to each partner so as to enable them to declare their partnership income within the stipulated period.

The Form CP30 Apportionment Of Partnership Income has to be provided to each partner so as to enable them to declare their partnership income within the stipulated period ie. The precedent partner is responsible for filling out the Form P and issuing the Form CP30 to each and every partner. Create Legal Documents Using Our Clear Step-By-Step Process.

B Failure to furnish Form P on or before 30 June 2021 is an offence under paragraph 1201d of the Income Tax Act 1967 ITA 1967. RM 40000 to RM 150000 depends on complexity of transactions if accounts are done by us c. LLP have a similar tax treatment like Company where chargeable Income from LLP will be taxed at the LLP level at tax rate of 24 generally.

Form LAMBADA HAIL DSLAM NEVER MALAYSIA PARTNERSHIP RETURN FORM P 1 Name of Partnership 2 Income Tax No. Tax Treatment of LLP. For change in business status complete item 3 on page 1 of the Form.

It said Ciscos CDA programme is a strategic partnership with governments worldwide to accelerate their national digitalisation agendas and create new value for the country businesses and citizens. 2 Submission through e-Filing e-P can be made via httpsmytaxhasilgovmy. A refer to the Explanatory Notes before.

You may also call us on Individual Income Tax Helpline at 1800-356 8300. 4 Number of Partners D YEAR OF ASSESSMENT 2011 UNDER SUBSECTION. LHDNM has to be notified in writing in case of any amendment to the Form P already submitted.

A partnership is considered as carrying on e-Commerce business if in deriving its income internet is used for. Form P deadline. Compared to Private Limited Company Sdn.

The Major Benefits Of Outsourcing Your Development Needs Development Web Development Outsourcing

Sample House Rental Agreement Malaysia Template Doc And Pdf Rental Agreement Templates House Rental Room Rental Agreement

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Terms Of Agreement Sample Inspirational 22 Examples Of Employment Contract Templates Word Contract Template Contract Agreement Employment

Business Activity Code For Taxes Fundsnet

Wecwi Seminar On Innovate Teaching Towards Personalised Learning Via Wbi An Alternative Of Lms Using Web 2 0

House Rental Contract Free To Print Doc And Pdf House Rental Contract Room Rental Agreement

40 Free Partnership Agreement Templates Business General

Huawei Malaysia Launches Tech4all Remote Education To Bridge Digital Divide

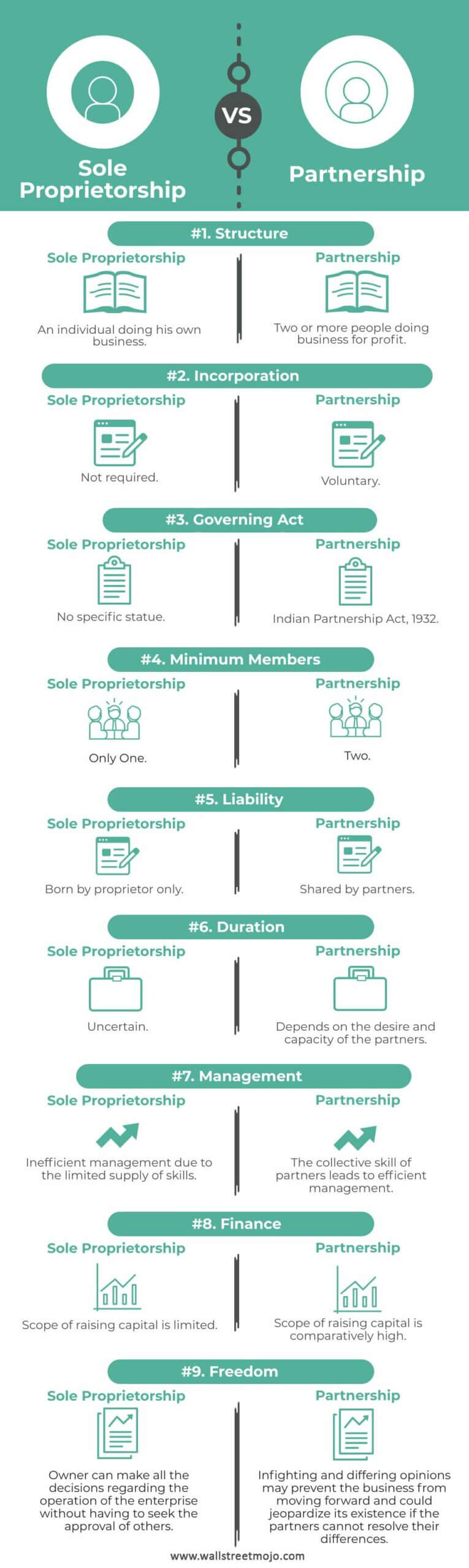

Sole Proprietorship And Partnership Sole Proprietorship Business Support Business Organization

Gst Malaysia Goods And Services Tax Brake Pads Malaysia Cal Logo

Regional Comprehensive Economic Partnership Rcep And India

Asia Forms World S Biggest Trade Bloc A China Backed Group Excluding U S Trade Bloc South China Sea World S Biggest

Letter For Authorizationfind Here An Example Of Sample Authorization Letter To Download In Doc Forma Lettering Rental Agreement Templates Cover Letter Template

Sample Apartment Lease Agreement Form In Word Apartment Lease Lease Agreement Rental Agreement Templates

Sole Proprietorship Vs Partnership Top 9 Differences With Infographics

Free Appointment Letter For Business Partner Template Google Docs Word Apple Pages Template Net Lettering Appointments Words